Small Home Gazette, Winter 2017

Shop ‘Til You Drop

When you think of the Roaring Twenties, words like flappers, jazz and prohibition come to mind. But do you think of the words “buying on credit”?

When you think of the Roaring Twenties, words like flappers, jazz and prohibition come to mind. But do you think of the words “buying on credit”?

The 1920s were a time of extremes—of dramatic political as well as social change. For example, the 1920 census showed that, for the first time, more than 50 percent of Americans lived in urban areas and more Americans worked in manufacturing than in agriculture. The nation’s total wealth more than doubled between 1920 and 1929. This economic growth swept many Americans into an affluent but unfamiliar “consumer society.”

As both manufacturing and farming became easier with the use of machines, more goods were available for purchase. The boom in business also led to more jobs and thus more people with money to spend on the newly manufactured goods. Many Americans had extra money to spend, and they spent it on consumer goods such as ready-to-wear clothes and home appliances. Radios, refrigerators and washing machines were popular items.

As both manufacturing and farming became easier with the use of machines, more goods were available for purchase. The boom in business also led to more jobs and thus more people with money to spend on the newly manufactured goods. Many Americans had extra money to spend, and they spent it on consumer goods such as ready-to-wear clothes and home appliances. Radios, refrigerators and washing machines were popular items.

The Installment Plan

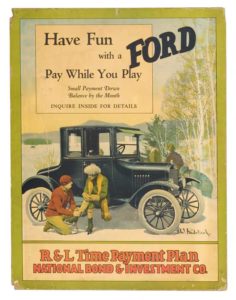

Talk about social change, the most important consumer product of the 1920s was the automobile. Affordable prices (the Ford Model T cost $260 in 1924; the equivalent of $3,670 today) and generous credit made cars affordable luxuries at the beginning of the decade; by the end, they were practically necessities. (By 1929, there was one car on the road for every five Americans.)

Talk about social change, the most important consumer product of the 1920s was the automobile. Affordable prices (the Ford Model T cost $260 in 1924; the equivalent of $3,670 today) and generous credit made cars affordable luxuries at the beginning of the decade; by the end, they were practically necessities. (By 1929, there was one car on the road for every five Americans.)

The installment plan of the 1920s, an arrangement that allowed people to buy what they wanted with a small down payment and pay off the rest in monthly installments, provided Americans a way to own what they did not have the money to buy. All the buyer had to do was put down some money and make payments until the financial obligation was met.

The plan seemed to be a win-win situation for all. Manufacturers kept producing; stores kept selling; and people bought to live better. No longer did the majority of people pay cash. Credit became popular, and consumer debt rose more than 100 percent during the 1920s. (By the end of the decade, more than 50 percent of cars were purchased on credit.)

The First Credit Cards

According to Encyclopedia Britannica, “…the use of credit cards originated in the United States during the 1920s, when individual firms, such as oil companies and hotel chains, began issuing them to customers.” Keep in mind, early credit cards were not like our plastic cards of today. Credit “tokens” have been made from metal coins, metal plates, celluloid, metal, fiber and paper.

During the early years of the 20th century, a few hotels issued credit cards to favored guests, but the cards were mainly a status symbol for participating customers.

Oil companies also issued their version of a credit card as a way to sell more goods and services. They offered cardholders some convenience when traveling but they weren’t accepted by competitors, and they were useful only at gas stations.

Department store cards also weren’t accepted by competitors, and unless they were issued by a national chain, they weren’t much use when traveling. The good news was the number of U.S. retail chain stores (with two or more stores) had increased from just one in 1872 to more than 1,000 in 1922.

Charge Plates

“Charge plates” were commonly used in department stores starting in the early 1930s. They were similar in size and shape to the now familiar U.S. military dog tag; made from metal; and had the department store name and the customer’s address and name embossed on it.

The most common brand of charge plates was called “Charga-Plate” and was used until the early 1960s. The Charga-Plate is an early predecessor to our plastic credit card.

The customer’s signature would be included on a paper insert on the back of the plate. Most of the stores would keep the charge plates in file cabinets and pull them out when the customers came in to charge a purchase. The plate was placed on an imprinter containing an inked ribbon, and an impression of the embossed plate was recorded on to a paper charge slip.

After the 1920s, there was no turning back. Widespread use of consumer credit became a way of life. But for the next 40 years it was still limited mainly to installment buying—”a small down payment and easy monthly payments,” as the ads used to say. The people who extended you the credit were the same ones who sold you the product.

After the 1920s, there was no turning back. Widespread use of consumer credit became a way of life. But for the next 40 years it was still limited mainly to installment buying—”a small down payment and easy monthly payments,” as the ads used to say. The people who extended you the credit were the same ones who sold you the product.

Credit cards as we know them today didn’t take off until the 1960s, when financial innovation, improved technology, and changing consumer attitudes converged.